Our Mission

Business Impact

10,000

+Customers Served

200

+Chit Schemes

600

CroresDisbursed

2

Offices

100

+Industries

15

+Experience

Savings

NavaShakthi chit funds are a good savings option for small investors. It brings discipline in investments and is a reliable source of funds in emergencies.

LEARN MORE

Marriage

Marriages are an expensive affair, but NavaShakthi chit funds provide liquidity required to fund the wedding of your children at a much lower interest rate.

LEARN MORE

Education

While child education is of prime importance, the increasing education costs can put an onus on parents. NavaShakthi chit funds can help up meet the education expenses easily.

LEARN MORE

Business Expansion

NavaShakthi Chit funds are a systematic saving scheme that offers flexibility to borrow much larger sums, especially when you want to expand your business.

LEARN MORE

Purchase Land

NavaShakthi Chit funds are a good investment that allows easy access to your savings, especially when you want to purchase land or book an apartment.

LEARN MORE

Travel Abroad

NavaShakthi Chit Funds offer hassle-free, liquid investments in a simple, systematic manner that can assist you for all your finance needs when traveling abroad.

LEARN MOREChit Funds Groups

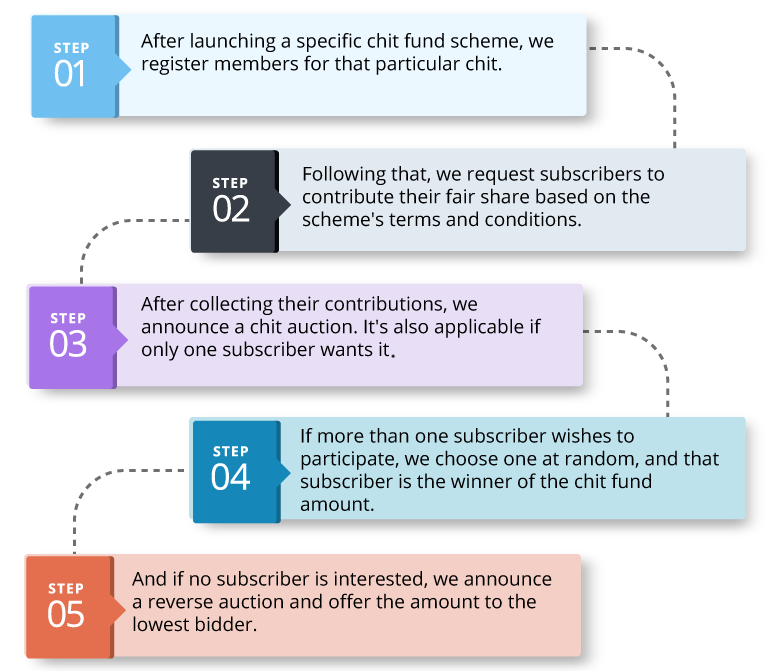

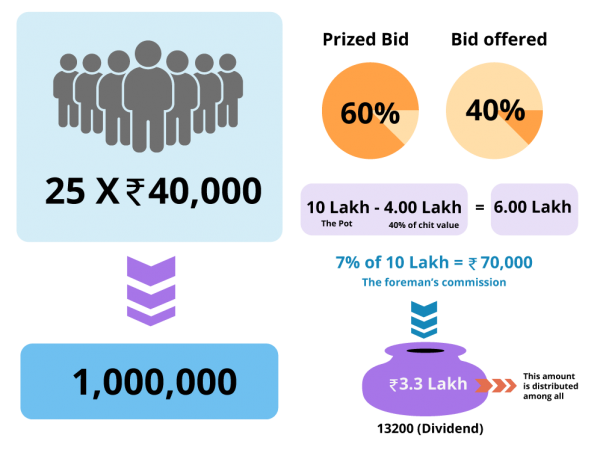

We offer various schemes depending on your monthly investment potentials to ensure we’ve got you fully covered.